BSS consolidation in five transactions

The run on stand-alone charging vendors has arrived.

BSS consolidation in five transactions

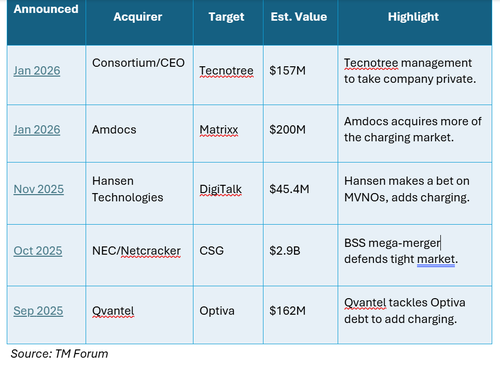

Since November 2025, five new M&A transactions have helped to reshape the telco BSS market (see timeline below). They also highlight a trend of large scale BSS platform providers acquiring stand-alone charging vendors for their customers and technology.

The prices BSS platform providers are paying for stand-alone vendors of real-time charging systems suggest the market

does not place huge value on the segment. The three acquisitions of charging vendors are valued at about $400 million in total, not discounting the $200 million or more in debt these entities collectively brought with them.

However, charging systems are necessary and complex standards-based elements for operating and monetizing mobile networks.

The 5G SA specification in particular appeared to offer an opening for stand-alone charging vendors to challenge network equipment manufacturers with software-based charging products.

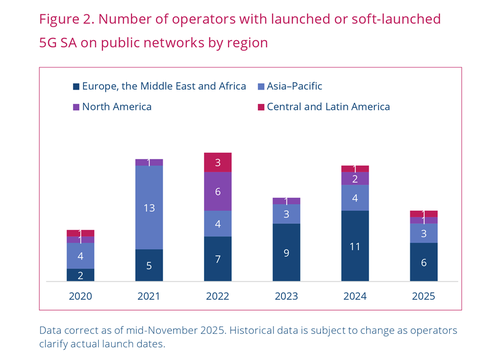

5G SA deploys a different charging architecture to that of 4G or non-standalone 5G standards and de-couples charging functions from network devices. As operators gradually adopt 5G SA they will need to upgrade their charging architecture. However, 5G SA deployments have been slow, as figures to the left, compiled by GSA, illustrate.

Two other transactions in recent months reflect a wider shake up of the BSS market: NEC’s acquisition of CSG International and Tecnotree’s announcement that its current management would buy out the company and take it private.

In the former case, it’s as close to a mega-merger as one will find in the BSS sector, marking a true consolidation of two major BSS providers and long-term rivals under common ownership. In the latter, it’s a sign that private money is still willing to make bets on BSS players if their track record and growth prospects can justify it.

Here’s a closer look at each of the five transactions:

Qvantel extends footprint with charging specialist Optiva

Qvantel started the recent acquisition run of stand-alone charging vendors (although Amdocs could say it got there first with its acquisition of Openet in 2020). In September Qvantel acquired Optiva, which was facing financial challenges, for roughly $162 million plus the absorption of $109 million of Optiva’s debt.

On the surface, it looks like an opportunistic buy that extends Qvantel’s customer footprint and adds complementary real-time charging technology to its product set at a relatively bargain price. When it comes to customers, there are several overlaps, including America Movil, stc, and MTN. But Optiva also brings in new customers in the form of BT, DT, KDDI, Ooredoo, Vodafone Idea, and Vodacom.

Hansen enters new sectors with charging specialist DigiTalk

In November, Hansen followed with its purchase of DigiTalk, which is an inexpensive bet on Hansen’s part to pick up a smaller charging and MVNE provider. Hansen was able to close this transaction for about a quarter of the price its rivals paid for other stand-alone charging providers.

The two companies share customers, namely Vodafone, Telefonica’s VMO2, and DISH. However, Hansen typically worked on retail products whereas DigiTalk focused on wholesale, MVNOs, and charging, including wholesale organizations at TATA Communications and Vodafone’s MVNO business.

Through this acquisition Hansen slightly expands its real-time charging capabilities and installed customer base, while potentially positioning its business better to capitalize on continued growth in the global MVNO market.

Amdocs bolsters charging portfolio with Matrixx Software

After years of acquisition rumours, Matrixx Software’s founders and investors might rest a tad easier knowing their deal garnered the top valuation in this bunch when Amdocs announced it would acquire Matrixx in January 2026 for roughly $200 million.

The Matrixx buy is strategic for Amdocs, which already has an established presence in the charging business, helped by its 2020 Openet acquisition. Amdocs and Matrixx share at least 16 customers, making the tie-up a naturally synergistic real estate purchase within key accounts like AT&T, Orange, and Verizon. Matrixx adds several key accounts, however, particularly in the Middle East with operator groups such as stc and Zain, which has already contributed positively to Amdocs’ revenue growth.

Also note that Matrixx Software is implemented in at least eight telcos where both Amdocs and Netcracker operate, including Orange, T-Mobile US, Telefonica, Telus, and Verizon. This makes the Matrixx buy a further bulwark against Amdocs’ chief rival, Netcracker, and defends against incursions from the other rival BSS vendors who will need to justify their acquisitions of stand-alone charging vendors with net-new sales.

NEC and CSG in cable BSS mega-merger

Charging isn’t the only factor reshaping the BSS market. October 2025 saw a BSS mega-merger when NEC announced it would acquire CSG International for nearly $3 billion. It is widely assumed this move will combine CSG with NEC’s subsidiary Netcracker, thereby joining two of the legacy BSS market’s long-time leaders.

From a BSS perspective, while there is substantial overlap across the Netcracker and CSG product portfolios, there is relatively little between the two companies’ customer bases (although this is less true from an OSS perspective where CSG’s BSS-centric role is often complementary to Netcracker’s OSS role). The acquisition therefore creates important synergies by allowing Netcracker to capture new footprint across multiple key accounts. But from a technology acquisition and complexity point of view, it adds another portfolio of products to Netcracker’s legacy estate.

A key takeaway from this deal is its impact on the North American cable TV market. CSG was long a key player serving major providers like Comcast and Charter, which NEC/Netcracker now take on. Netcracker became a key player in the North American cable market after acquiring Convergys’ billing business in 2012, serving operators like Cox and Rogers. After acquiring CSG, Netcracker will provide core BSS for 8 of the top 10 cable providers’ fixed line businesses.

Hot on their heels, however, is Amdocs, which supports Altice, Charter, Comcast, and Rogers mobile businesses – four of the top five cable operators in the region.

Tecnotree takes itself private

Tecnotree announced in January 2026 that the company’s board recommended its shareholders accept a purchase offer of roughly $157 million from a consortium of its CEO Padma Ravichander and two private equity groups, Helios Investment Partners and Fitzroy Investments Limited. The aim is to delist the currently public entity and make it private. This deal shows that there are still private money interests willing to invest in BSS platform companies, at least if they can achieve the scope, cash flow, growth, and installed base of Tecnotre.

Going private makes sense for Tecnotree because it removes the need to meet market expectations and to hit quarterly numbers. This allows the company to make bets – ideally with their new investors’ money – on their product, customers, markets, and brand without quarterly scrutiny.

New bets could include acquisitions. But Tecnotree, which already has its own convergent charging system as well as a full-scale BSS platform for retail, wholesale, and B2B2x could also be an attractive acquisition target. Especially as it crosses over on a handful of customer accounts with Netcracker and Matrixx Software, for example. From that perspective, taking the company public also helps to protect Tecnotree from a hostile takeover bid by one of its much larger rivals.